Silver IRAs offer investors a unique way to diversify retirement savings by investing in physical precious metals, with the help of reputable silver IRA companies. These firms facilitate the purchase, storage, and management of assets within an IRA account, providing tax advantages like tax-deferred growth. Silver, known for its intrinsic value and safe-haven status, has historically contributed to long-term wealth building. Top-rated companies like Goldco, Silversport, and MINT offer secure storage, diverse investment products, and educational resources. Choosing the right custodian is crucial for safeguarding investments; look for robust security, transparent operations, and a proven track record. Setting up a Silver IRA involves opening an account, funding it, and selecting desired precious metals. Growing a silver portfolio through these companies offers strategic diversification, with options tailored to individual risk tolerance and goals. Regular review and staying informed about trends are essential for long-term success.

Looking to diversify your retirement portfolio with precious metals? Discover the power of a Silver IRA, a unique investment option offering tax advantages and potential for growth. This comprehensive guide explores the benefits of investing in silver, delves into top-rated Silver IRA companies, provides expert tips on choosing the right custodian, and navigates the setup process from start to finish. Maximize your retirement savings with our detailed analysis of Silver IRA companies.

- Understanding Silver IRAs: A Comprehensive Overview

- The Benefits of Investing in Precious Metals

- Top Silver IRA Companies: A Detailed Analysis

- Choosing the Right Custodian for Your Silver IRA

- Navigating the Process: From Setup to Contribution

- Growing Your Silver Portfolio: Strategies and Tips

Understanding Silver IRAs: A Comprehensive Overview

Silver IRAs, also known as precious metal IRAs, offer investors an alternative investment option within their retirement accounts. These accounts allow individuals to invest in physical silver or gold as a way to diversify their portfolio and potentially protect against inflation. Understanding Silver IRA companies is crucial when considering this unique investment vehicle. Reputable firms in this space provide the infrastructure for buying, storing, and managing precious metals within an IRA account.

When exploring Silver IRAs, it’s essential to research different silver IRA companies to find one that aligns with your financial goals and risk tolerance. These companies often charge fees for their services, including storage, administration, and potential insurance costs. The process involves opening an IRA account with a chosen company, funding it, and selecting the specific precious metals you wish to invest in, whether that’s silver bars, coins, or other approved forms.

The Benefits of Investing in Precious Metals

Investing in precious metals, such as silver, offers a range of benefits that can help individuals diversify their portfolios and protect their financial future. One of the key advantages is their intrinsic value; unlike paper currencies, which are subject to inflation and market fluctuations, precious metals have been recognized as valuable assets for centuries. This makes them an excellent hedge against economic uncertainty and potential currency devaluation.

Additionally, when you invest in silver through a Silver IRA company, you gain access to tax advantages. IRAs (Individual Retirement Accounts) allow for tax-deferred growth of your investments, meaning you won’t owe taxes on the gains until you withdraw the funds during retirement. This can significantly boost your savings over time. Moreover, precious metals like silver have historically been considered a safe-haven asset, providing peace of mind during economic downturns and offering potential for capital appreciation, thus contributing to long-term financial security.

Top Silver IRA Companies: A Detailed Analysis

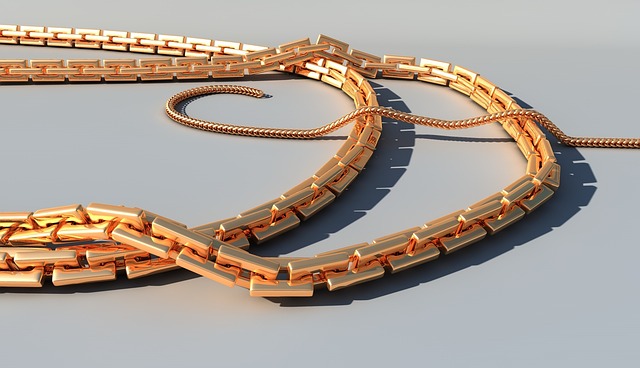

When it comes to investing in precious metals, a Silver IRA (Individual Retirement Account) is a popular choice for diversifying retirement portfolios. Among the top Silver IRA companies, several stand out due to their reliability, security, and diverse investment options. These companies offer investors a seamless way to hold physical silver as part of their retirement savings plan.

A detailed analysis reveals that reputable Silver IRA companies like Goldco, Silversport, and MINT provide robust storage solutions, including secure vault facilities. They also offer a wide range of silver products, from bars and coins to unique investment packages. These companies prioritize customer satisfaction by delivering comprehensive education resources, making it easier for investors to navigate the complexities of precious metal IRAs. Additionally, their experienced support teams ensure a smooth roll-over process from traditional IRAs, promoting a seamless transition for retirement planning.

Choosing the Right Custodian for Your Silver IRA

When considering a Silver IRA, selecting the right custodian is an essential step in ensuring your investment’s safety and growth. Researching and choosing among reputable silver IRA companies is crucial as it directly impacts your financial future. Look for custodians that specialise in precious metals and have a proven track record of secure storage and transparent operations.

Check their security measures, insurance coverage, and the ease of buying and selling physical silver. Reputable silver IRA companies should provide regular statements, flexible investment options, and knowledgeable customer support to guide you through the process. Ensure they adhere to regulatory standards and maintain compliance with IRS rules to protect your retirement savings.

Navigating the Process: From Setup to Contribution

Navigating the process of setting up and contributing to a Silver IRA is an important step for those looking to invest in precious metals as part of their retirement savings strategy. The first step involves selecting a reputable Silver IRA company, which offers specialized accounts catering to this type of investment. These companies provide the necessary infrastructure and expertise to facilitate the secure storage of physical silver on behalf of investors.

Once chosen, the process begins with opening an account, typically done online or over the phone. Investors will need to provide personal information and financial details. From there, they can choose their investment options, whether it’s buying physical silver bullion or investing in funds that track the price of silver. The Silver IRA company will guide investors through the contribution process, ensuring compliance with tax regulations and offering support for a smooth transition into this alternative retirement savings vehicle.

Growing Your Silver Portfolio: Strategies and Tips

Growing your silver portfolio can be a strategic way to diversify and potentially enhance your financial landscape, especially with the guidance of reputable silver IRA companies. These firms specialize in helping individuals invest in precious metals as part of their retirement accounts, offering a unique avenue for asset allocation. One effective strategy is to start by evaluating your risk tolerance and investment goals; this will dictate how much you allocate to silver and other assets within your portfolio. Diversification is key; consider spreading your investments across various forms of silver, such as bullion, coins, or even ETFs, to mitigate risks associated with any single asset class.

Reputable silver IRA companies provide access to a wide range of investment options, allowing you to tailor your portfolio to your preferences. They offer the convenience of direct acquisition and storage, simplifying the process for beginners and seasoned investors alike. Keep in mind that market fluctuations are inevitable, so staying informed about precious metal trends is essential. Regularly reviewing your portfolio and adjusting as needed will contribute to long-term success.

In conclusion, investing in a Silver IRA offers a unique way to diversify your retirement portfolio with the potential for long-term growth. By exploring top-rated silver IRA companies and understanding the process thoroughly, you can make informed decisions. Remember, when choosing a custodian, opt for one that aligns with your financial goals and provides secure storage. With the right strategies, growing your silver portfolio can be a rewarding journey, allowing you to safeguard your retirement savings while embracing the benefits of precious metals investing.